PEPE’s value chart is flashing daring indicators {that a} main comeback may very well be brewing. After weathering a pointy correction, the memecoin seems to be setting the stage for a strong new rally, mapped out clearly by means of an rising Elliott Wave sample.

The weekly chart exhibits that the token just lately accomplished a traditional ABC corrective wave, bottoming out alongside a key multi-year trendline that has traditionally acted as a launchpad for bullish strikes. From there, a recent five-wave impulse is in movement. The primary wave (i) has already unfolded, adopted by a wholesome dip (ii), and now all eyes are on the following huge leg up.

PEPE Value Chart (Supply: TradingView)

If this wave depend holds, PEPE may climb to the 0.786 Fibonacci degree close to 0.000024 earlier than a slight pullback (iv) clears the runway for a ultimate wave (v) concentrating on a excessive round 0.00002836. That’s practically a 180% enhance from its present value of round 0.00000993.

Crucially, the assist line that the frog-themed meme coin simply bounced from has held robust for over a 12 months, giving confidence to this bullish construction. So long as the value stays above the 0.00000526 “invalidation space,” the upside situation stays in play.

PEPE Value Balances at Main Turning Level

The newest Murrey Math Traces chart reveals a crucial juncture in PEPE’s value construction, including additional energy to its bullish outlook. Primarily based on this indicator, the token is perched proper above a crucial zone often called the “backside of the buying and selling vary” at 0.00008940—a degree typically related to development reversals and recent momentum.

If the cryptocurrency can elevate above the following key marker at 0.00011920, it may unlock a path towards greater resistance zones. Consider it like climbing a staircase: 0.00014901 marks the following step, with the final word ceiling standing tall at 0.00023841. That’s the extent labeled “Final Resistance,” and it’s the place the true fireworks may start.

PEPE Value Chart (Supply: TradingView)

However the climb isn’t assured. A slip under 0.00005256 would ship a powerful bearish sign, probably pulling the cryptocurrency again into oversold territory. Till then, this zone acts as the ground merchants are betting gained’t break.

Volatility Brews Beneath PEPE’s Calm Chart

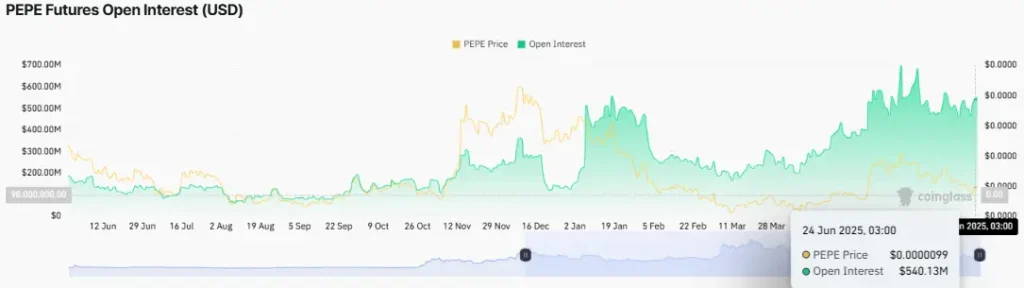

The calm earlier than the storm? Backing the technical setup is PEPE’s futures market, which is buzzing beneath the floor. In response to CoinGlass knowledge, the token’s open curiosity has swelled to over $540 million—its highest degree in months—regardless of value motion staying comparatively muted.

PEPE Futures Open Curiosity (Supply: CoinGlass)

This accumulation of cash is a bullish indication of merchants quietly positioning themselves for the following blowout. This sort of escalation not often comes with a peaceable finish. Prior to now, a rise in open curiosity in a state of affairs when costs are in consolidation brought on vital volatility.

Simply as one would coil a spring: the tighter the coil, the snappier the spring. Be it a breakout or a fake-out, the market is clearly getting strapped. The brand new query is just not whether or not PEPE will go, however when.

Additionally Learn: SOL Explodes to 1.75M Futures Quantity as Value Eyes $145 Breakout