Berlin, Germany, June 18th, 2025, Chainwire

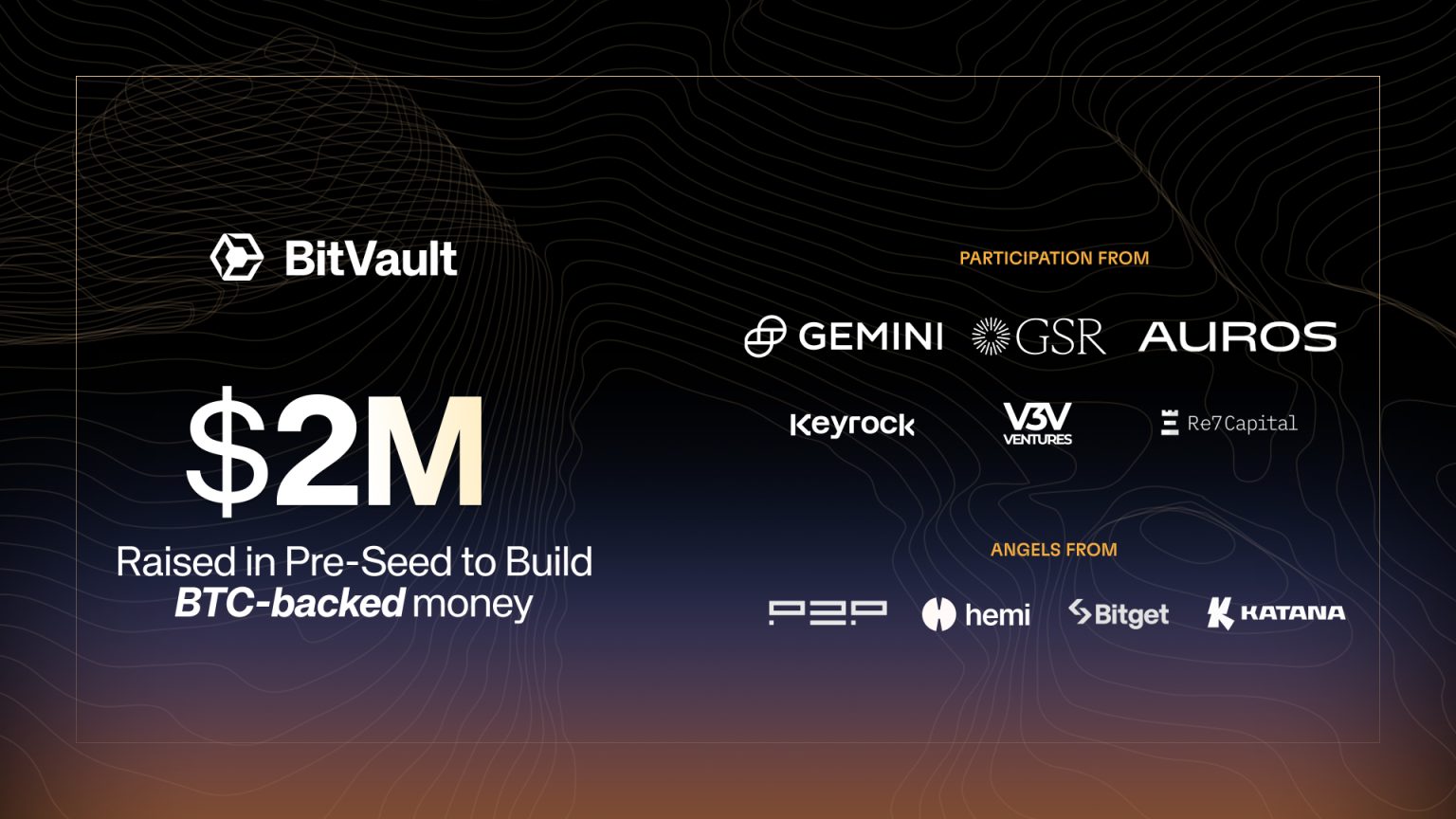

BitVault, a DeFi protocol aiming to redefine Bitcoin’s position in stablecoin infrastructure, has introduced the shut of a $2 million pre-seed spherical. Strategic buyers embrace GSR, Gemini, Auros, and Keyrock, amongst others—becoming a member of BitVault in constructing what it calls the “subsequent period of BTC-backed cash”: an institutionally-aligned different to fiat-pegged stablecoins.

The increase helps the launch of bvUSD, BitVault’s overcollateralized stablecoin backed by Bitcoin derivatives, and sbvUSD, its yield-bearing variant powered by institutional buying and selling methods by GSR.

BitVault will function a core stablecoin protocol on Katana, a brand new DeFi-first chain incubated by Polygon Labs and GSR prioritizing deep liquidity and person rewards, leveraging a licensed fork of Liquity V2 to allow permissioned borrowing, user-set rates of interest, and automatic liquidation infrastructure.

“Bitcoin was constructed for moments of fracture. BitVault was constructed to make it usable,” stated Michael Kisselgof, Core Contributor of BitVault and VaultCraft. “We particularly onboarded GSR, Auros, and Keyrock as strategic buyers that may additionally execute excessive yielding, non-directional methods to create demand and deep liquidity for BTC-backed cash.”

Stablecoins at an Inflection Level

BitVault arrives amid rising demand for crypto-native stability in a fragmented international financial atmosphere. Not like fiat-backed stablecoins like USDC or algorithmic choices like Ethena’s USDe, bvUSD is collateralized by BTC derivatives.

Solely whitelisted institutional debtors can mint bvUSD in bulk, whereas anybody can mint bvUSD utilizing stablecoins—mitigating dangers related to overleveraged or nameless borrowing. DeFi customers can earn yield by staking bvUSD into sbvUSD, which leverages delta-neutral and arbitrage methods managed by GSR, a globally acknowledged crypto funding agency specializing in market making, OTC buying and selling, and choices..

“We’re seeing rising curiosity in BTC-backed stablecoins, particularly these designed to combine seamlessly into DeFi ecosystems,” stated Alain Kunz, Director from GSR, who participated within the spherical. “BitVault’s method with expertise in institutional-grade yield methods positions it properly for fulfillment. We’re notably enthusiastic about its deployment on Katana, a DeFi centric chain we helped incubate. BitVault provides to Katana’s evolving ecosystem by introducing a brand new layer of stablecoin utility, enabling BTC to tackle a extra productive position inside Katana’s high-yield DeFi stack.”

From Liquity to Katana

BitVault is a pleasant fork of Liquity V2, re-engineered for institutional use beneath a licensed deployment settlement with Liquity AG. The protocol blends automated, governance-free mechanisms with a permissioned borrowing layer, providing stability whereas retaining core DeFi primitives like direct redemption and composable yield methods.

Its upcoming VCRAFT token will govern future protocol parameters and function a rewards mechanism for stability suppliers and liquidity contributors.

The launch on Katana, incubated by Polygon Labs and GSR, positions BitVault on the coronary heart of an rising liquidity and settlement community throughout the EVM chain. Preliminary integrations embrace Vault infrastructure, Morpho cash markets, Sushi AMMs, and a multichain “Bits” factors marketing campaign tied to VCRAFT distribution.

What’s Subsequent

BitVault is scheduled for mainnet deployment on Katana in June 2025, with broader integrations throughout DeFi ecosystems and centralized liquidity venues within the works. The workforce plans to increase its stablecoin suite to assist extra BTC-based collateral belongings and is actively onboarding institutional debtors.

About BitVault

BitVault is a DeFi protocol that gives a crypto-native resolution for cash via its BTC-backed stablecoin, bvUSD, and a yield-bearing staked stablecoin, sbvUSD. The protocol is designed to supply an institutional-grade, capital-efficient stablecoin with user-set rates of interest, multi-collateral backing, and enhanced liquidity mechanisms.

For media inquiries or partnership data:

press@bitvault.finance

Contact

BitVault Group

BitVault.Finance

information@bitvault.finance

BitVault Raises $2M from GSR, Gemini, and Auros to Launch BTC-Backed Money