Chainlink (LINK) has been on a downward pattern since December 2024 from a peak of about $28.00. At the moment, LINK trades at $11.36 with a 2.06% lower in worth during the last 24 hours. The token has misplaced greater than 60% of its worth because it was final priced at $28.00 4 months in the past.

Will a reversal happen, or will the value plunge beneath the $10 help degree?

Chainlink Worth Evaluation

The every day chart for LINK exhibits a bearishness since December 2024. The value has created a number of decrease peaks at necessary Fib ranges $26.71 (0 Fib), $24.38 (0.236 Fib), and $22.95 (0.382 Fib). The latest crash in worth exhibits LINK struggling to carry again help at $10.78.

The EMAs painting a bearish setup, with LINK presently buying and selling beneath all important EMAs. The 50 and 200 day EMAs exhibit a bearish cross, with the previous bearing down extra steeply. The value has been persistently rejected by the 50 and 200 EMAs because the starting of February 2025, with the newest rejection being at round $16.00 in late March.

The MACD indicator exhibits bearish momentum, with the MACD line buying and selling beneath the sign line at -0.95. The histogram is displaying -0.22, indicating sustained bearish strain. In the meantime, from the tip of March to the start of April, worth actions counsel a bullish divergence establishing itself.

A descending channel that has contained the value of LINK since December. The channel runs from round $28.00 on the December excessive to the present $11.36 worth degree. In January, February, and March, the higher resistance trendline has persistently rejected worth rally makes an attempt at $24.00, $20.00, and $16.00, respectively, whereas the decrease help line has been examined extra regularly.

The LINK worth presently finds help at $10.78 degree, whereas beneath this, the 1.618 Fibonacci extension at $10.78 would function important help. The resistance now seems at quick ranges of $14.19 (1.272 Fib) that coincide with the March 23-28 consolidation space following the psychologically necessary $16.86 (1.0 Fib), which has rejected worth advances twice in March.

LINK Worth Targets

If LINK worth can keep help above the $10.78 degree, then that would result in a reversal goal of about $14.19. For a serious restoration, Chainlink must break the higher boundary of the descending channel, which is presently round $16.00. Such a breakout would point out a reversal of the pattern.

On the flip facet, if LINK worth falls beneath the help degree of $10.78, promoting strain may improve towards the psychological $10.00 degree, which is in keeping with projected channel help.

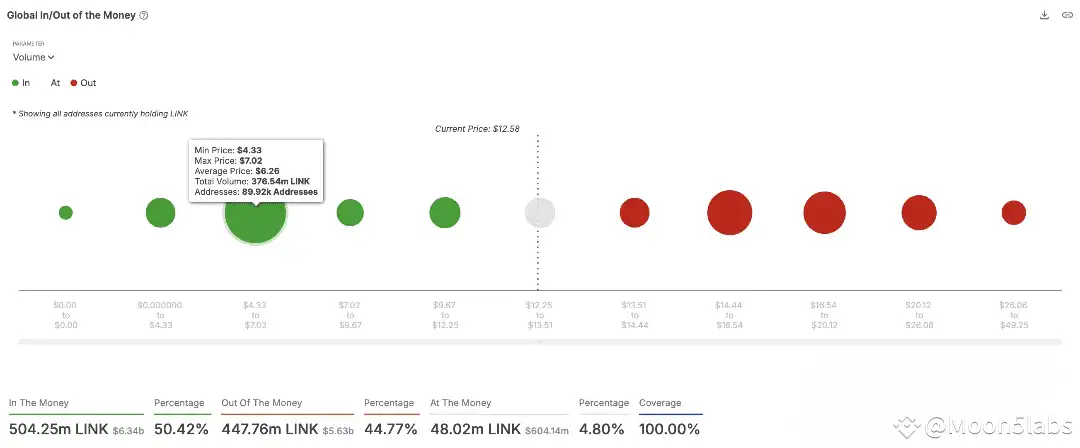

376 Million LINK Purchased Close to $6

The analytics platform, Intotheblock, reveals that over 376 million LINK tokens have been amassed across the $6 mark, making it a important demand wall that would present help in case of one other main drop.

About 50% of holders are in revenue, whereas practically 45% are within the pink. If LINK breaks beneath $12.25, panic promoting may speed up.