Ethereum has been underneath vital bearish strain for the previous few months, with costs dropping from round $4,100 to the current stage of $1,607, this represents a lower of round 62% in value. The altcoin was up by 9.8% over the previous 24 hours. This rally got here after President Trump introduced a 90-day pause on reciprocal tariffs.

Even after this rally ETH is caught contained in the descending channel. Will it break above the fast resistance of $1,809 or a break right down to $1,100 is about to occur?

Ethereum Value Evaluation

ETH is at the moment attempting to determine a assist stage close to $1,550 after being severely bought off in late March and within the first week of April. The emergence of a comparatively massive inexperienced candle, implying purchase curiosity at present ranges on the ninth of April, has little quantity suggesting a significant fast reversal.

All key EMAs are stacked bearishly above the present value, with the 50 EMA performing as resistance close to $2,000. The given distance between the present value and the EMAs signifies how sturdy the continuing downtrend is, with no bullish crossover perception.

The RSI is about 37.17, nearing the oversold zone however not but in excessive territory. This example suggests the likelihood of a technical bounce. The RSI had been in a downtrend since December and had failed to point out any constructive divergences.

ETH is at the moment caught in a descending channel. The worth has not too long ago approached the decrease trendline of the channel, suggesting a assist take a look at. This sometimes continues till a decisive breakout happens.

A few of the vital resistance ranges are $1,785, $2,000 (psychological stage), and $2,385 . The draw back fast assist lies at $1,539 with the most important psychological at $1,500. The final bounce occurred from the decrease boundary of the channel, indicating that this stage is being defended by consumers aggressively.

ETH Value Targets

If ETH breaks beneath the decrease boundary of the channel, then the fast goal could be $1,400, which is a 13.5% decline from its present ranges.

On the upside, a decisive break above the channel’s higher boundary may see ETH testing the 50-day EMA close to $2,000, which might require a 23.7% rally.

For a real pattern reversal, Ethereum would wish to interrupt out of the descending channel with vital quantity, reclaim the $2,000 stage, and see the RSI set up itself above 50. Till then, the bearish strain will proceed to dominate the second-largest cryptocurrency.

Spot Ethereum ETF flows stay weak

In line with SoSoValue knowledge, on ninth April, the whole web outflow of Ethereum spot ETFs was $11.18 million, and not one of the 9 ETFs had a web influx. The Ethereum spot ETF with the most important web outflow in a single day yesterday was Constancy ETF FETH, with a single day web outflow of $5.73 million. Presently, the whole web influx of FETH in historical past has reached $1.40 billion.

It has recorded $94.1 million in outflows over the past two weeks in opposition to $13 million in inflows.

Whale Exercise

An Ethereum OG dumped 10,702 ETH ($16.86) at $1,576 once more after 2 years of dormancy, He purchased when the value was simply $8. Apparently, he by no means bought when ETH was above $4000 however all the time selected to promote throughout main dips.

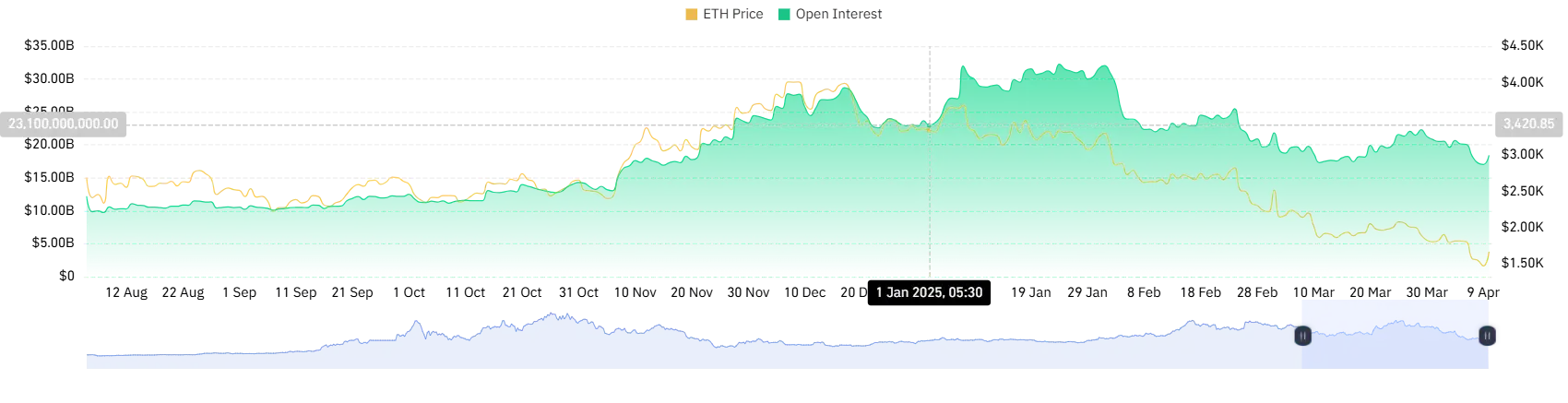

Ethereum Witnesses Low Open Curiosity and Damaging Funding Charges

Lack of enthusiasm within the derivatives market is one other issue for ETH’s value decline. The entire variety of futures and choices contracts stays low, indicating diminished dealer participation.

Presently, at $16.7 billion, Open Interest is 48% beneath the height of $32.3 billion witnessed on Jan 24. Declining OI indicators a slack in confidence and curiosity from the traders.

Additionally Learn: Will Bulls Enhance Ethereum Value Again To $2,000 Inside Parallel Channel?