A key side of Thorn’s evaluation is the unwavering power of Bitcoin’s long-term holder base, which he estimates to carry about 75% of the full BTC provide. “Lengthy-term holders are nonetheless principally holding robust,” Thorn notes, emphasizing the group’s resilience and religion in Bitcoin’s long-term worth proposition. This demographic, characterised by their ‘diamond arms’, performs an important function in stabilizing the market and buffering in opposition to the volatility that usually defines the crypto area.

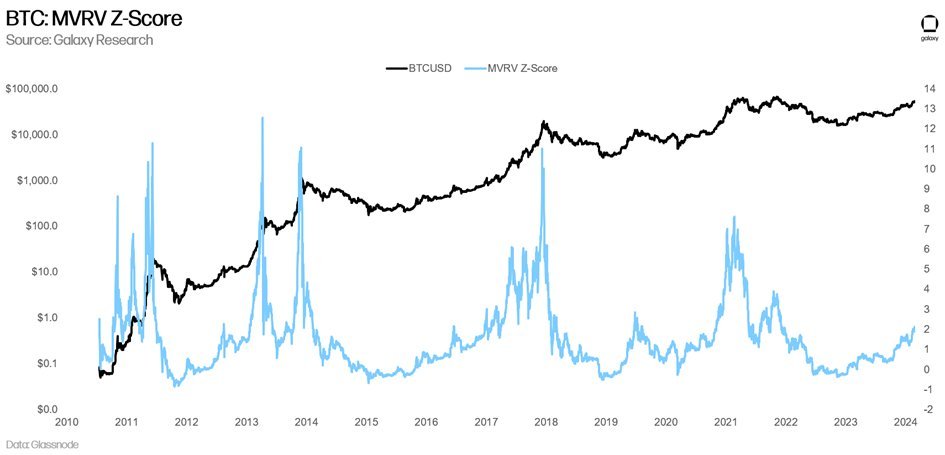

Thorn additional elaborates on the analytical instruments and metrics that present perception into Bitcoin’s market habits. He introduces the MVRV Z-Rating, a novel strategy to understanding the cyclicality of Bitcoin’s value motion by evaluating its market worth to its realized worth. This metric presents a window into the perceived overvaluation or undervaluation of Bitcoin at any given level. At present, the MVRV Z-Rating is near 2, whereas earlier cycle tops noticed the metric spike to eight (in 2021) and even above 12 (in prior halving cycles).

Addressing the hypothesis across the acceleration of the Bitcoin cycle, Thorn firmly dispels considerations that the market is prematurely peaking. He argues in opposition to the notion that we’re “speedrunning the ‘cycle’”, as a substitute asserting that the arrival of Bitcoin ETFs in the US represents a transformative shift with far-reaching implications. “This time is totally different,” Thorn asserts, pointing to the ETFs’ disruption of conventional Bitcoin value cycles and their affect on investor habits and intra-crypto dynamics.

The Spot Bitcoin ETF Impact

Thorn underscored the transformative affect of Bitcoin ETFs, positing that we’re merely originally of a major shift in how Bitcoin is accessed and invested in, notably by the institutional sector. “Regardless of unbelievable volumes and flows, there’s loads of purpose to imagine that the Bitcoin ETF story remains to be simply getting began,” he acknowledged, pointing to the untapped potential throughout the wealth administration sector.

Of their October 2023 report titled “Sizing the Marketplace for the Bitcoin ETF,” Galaxy laid out a compelling case for the long run development of Bitcoin ETFs. The report highlights that wealth managers and monetary advisors symbolize the first internet new accessible marketplace for these autos, providing a beforehand unavailable avenue for allocating shopper capital to BTC publicity.

The magnitude of this untapped market is substantial. In line with Galaxy’s analysis, there’s roughly $40 trillion of belongings beneath administration (AUM) throughout banks and dealer/sellers that has but to activate entry to identify BTC ETFs. This contains $27.1 trillion managed by broker-dealers, $11.9 trillion by banks, and $9.3 trillion by registered funding advisors, cumulating to a complete US Wealth Administration AUM of $48.3 trillion as of October 2023. This knowledge underscores the huge potential for Bitcoin ETFs to penetrate deeper into the monetary ecosystem, catalyzing a brand new wave of funding flows into Bitcoin.

Thorn additional speculated on the upcoming April spherical of post-ETF-launch 13F filings, suggesting that these filings would possibly reveal important Bitcoin allocations by a few of the largest names within the funding world. “In April, we may also get the primary spherical of post-ETF-launch 13F filings, and (I’m simply guessing right here…) we’re prone to see some enormous names have allotted to Bitcoin,” Thorn anticipated. This improvement, he argues, may create a suggestions loop the place new platforms and investments drive greater costs, which in flip attracts extra funding.

The implications of this suggestions loop are profound. As extra wealth administration platforms start to supply entry to Bitcoin ETFs, the inflow of latest capital may considerably affect BTC’s value dynamics, liquidity, and general market construction. This transition represents a key second within the maturation of Bitcoin as an asset class, shifting from a speculative funding to a staple in diversified portfolios managed by monetary advisors and wealth managers.

We Are Nonetheless Early

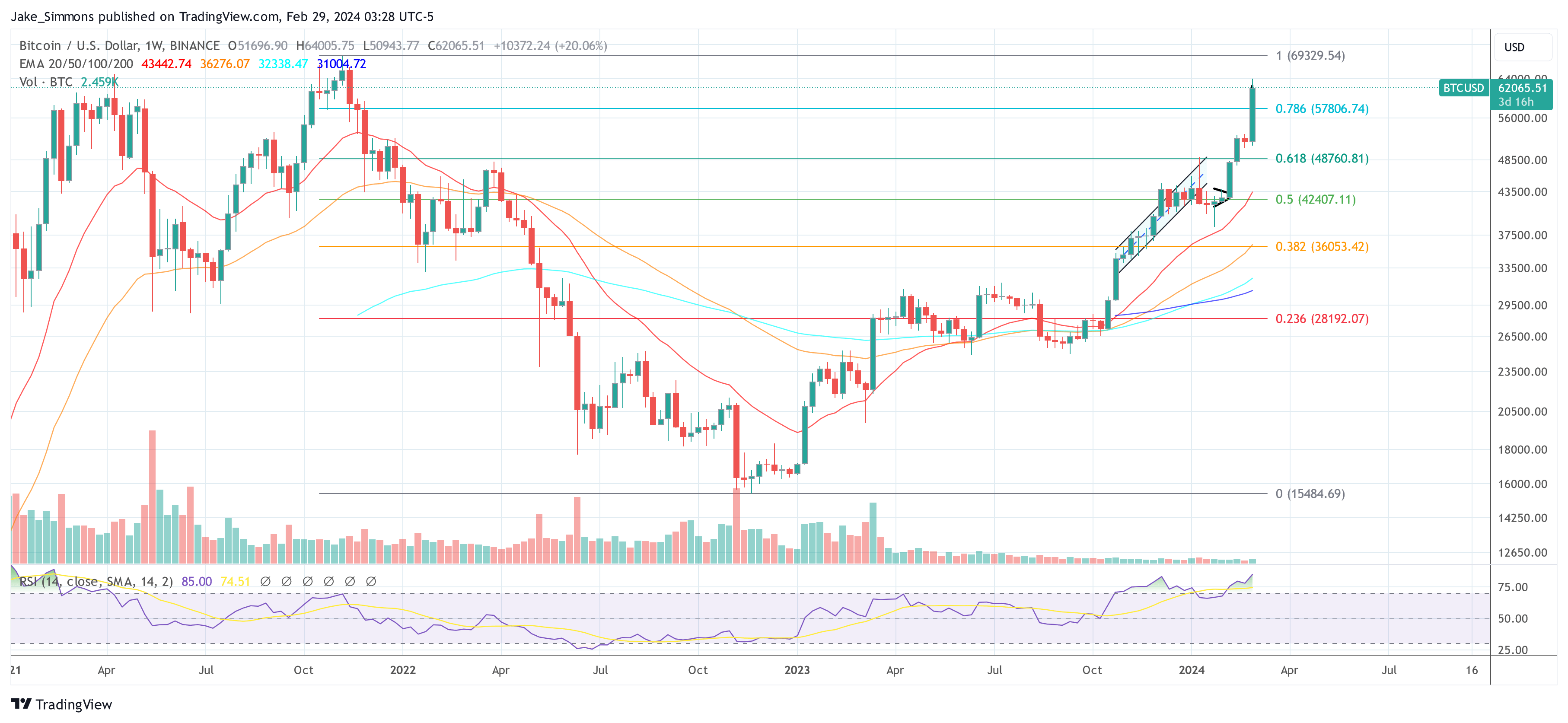

Thorn’s optimism extends past the instant market indicators to the broader implications of Bitcoin’s integration into the monetary mainstream. He anticipates a brand new all-time excessive for Bitcoin within the close to time period, fueled by a mixture of things together with the ETFs’ momentum, rising acceptance of BTC as a reputable asset class, and the anticipatory buzz surrounding the upcoming halving occasion. “All that is to say, my reply to that burning query – the place are we within the cycle? – is that we haven’t even begun to succeed in the heights that is prone to go,” he concludes.

Thorn’s evaluation culminates in a bullish forecast for Bitcoin. Because the group stands on the cusp of the fourth BTC halving, Thorn’s insights provide a compelling imaginative and prescient of a market poised for unprecedented development, pushed by a confluence of technological innovation, regulatory evolution, and shifting world financial currents. “Bitcoin is prime time now, and whereas it is likely to be exhausting to imagine, issues are simply beginning to get thrilling,” Thorn declares, capturing the essence of a market on the threshold of a brand new period.

At press time, BTC traded at $62,065.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site completely at your personal danger.