After half a 12 months of anticipation, regulators from the SEC greenlighted the introduction of assorted funds linked to Ethereum. Among the many most eagerly awaited are Invesco’s Galaxy Ethereum ETF, recognized merely as QETH, the Bitwise Ethereum ETF labeled ETHW, and the Grayscale Ethereum Mini Belief, going by the ticker ETH. These merchandise promise to ship publicity to Ethereum’s value swings in a fashion acquainted to conventional traders. They’re poised to draw appreciable sums of recent capital of their debuts as some look ahead to choices on this rising asset class to reach lastly. Based mostly on the technicals, an enormous help stage lies round $3,350, and important resistance is at $3.6k. Nevertheless, the Ethereum value has remained comparatively excessive regardless of the notable improve in buying and selling quantity as a result of approval. Analysts have additionally raised considerations that the precise help stage for Ethereum ETFs is considerably decrease than many had anticipated.

Why is Ether Crumbling Down?

Bloomberg analysts James Seyffart and Eric Balchunas reported that the SEC additionally allowed Grayscale Investments to transform its Grayscale Ethereum Belief (ETHE) right into a spot ETF. As with the prevailing lineup of Grayscale merchandise, every new spot change fund will maintain Ether (ETH), Ethereum’s native cryptocurrency token. Bloomberg Information additionally reported that the majority new ETFs will commerce on CBOE-Normal. Nevertheless, the worth of Ethereum dropped by 1.25% because the wee hours of Tuesday.

Regardless of the rise in buying and selling quantity, Ethereum’s free-falling value could be attributed to many causes. First, the overall market sentiment can nonetheless be bearish, and costs may lower regardless of larger commerce volumes. That method of promoting generally is a drag on costs when giant holders appear to promote to capitalize, and the buying and selling vary expands, main them to function from each side. Even on this atmosphere, ongoing regulatory scrutiny and uncertainty could possibly be one of many elements affecting investor urge for food for brand new listings. As well as, a number of Ethereum ETFs launched concurrently doubtless contributed to a decreased impact in value progress in comparison with Bitcoin’s single ETF launch.

ETFs Enhance Buying and selling Volumes and Market Sentiment, however Value Surge Falls Quick

Earlier than being accredited, many out there noticed the ETH ETF as a method of sending ether costs to new heights. The thought was that institutional money would stream into the area as extra traders noticed publicity, rising demand, and rising costs. The approval was anticipated to coincide with elevated buying and selling volumes as new and current traders purchased or dumped ETH on the information of the ETF going dwell.

Ethereum prices $3,452.31, a rise of 1.25% inside a day. This may be seen as a extra favorable value motion than the extremists anticipated however nonetheless removed from what they anticipated after getting ETF approval. Ethereum has a market cap of $420.06 billion; roughly 120 million cash have been circulated when this text was revealed. The value of Bitcoin has since remained roughly steady, and a considerable however not explosive improve in market capitalization. The anticipated flood of buying and selling quantity has come, however not exactly to the diploma it was initially thought. This quantity improve factors to elevated investor participation – from hypothesis and extra long-term funding types alike – however has but to lead to a considerable value acquire.

Stakes are excessive!

As of twenty first July, staked ETH remained in a robust Epoch of 33 million. The excellent news is, nonetheless, that constant ranges of Ether (ETH) stake reveal a number of fundamentals. A constant quantity of ETH is staked, which signifies that the variety of new entrants into the stake ecosystem is proscribed, or (from one other perspective) many stakeholders are selecting to chorus from withdrawing their stakes as a result of they’re successfully locked out. Secondly, it suggests sturdy investor confidence amongst stakeholders in Ethereum’s Proof-of-Stake (PoS) system, signaling perception within the long-term safety and efficiency of the community and, thereby, the token. So, new traders won’t lose cash but in addition won’t acquire cash.

Ethereum ETFs Underwhelming: Anticipated Traction Falls Quick

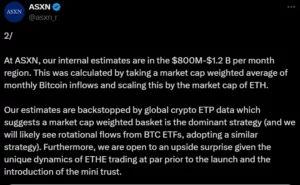

Within the July 22 analysis report, Wintermute discovered that Ethereum ETFs will pull between $3.2 billion and $4 billion by way of their first 12 months as a product class, main up from nothing simply earlier than launch. That is considerably decrease than the preliminary estimates and figures of Bitcoin ETF inflows, in comparison with $32 billion from Bitcoin ETF by year-end, or 10-12%. Alternatively, boutique crypto asset agency ASXN is extra bullish about the way forward for Ethereum ETF inflows and anticipates seeing a median month-to-month funding of between $800M – $1.2B monthly into this market. Nevertheless, regardless of these inflows, analysts are nonetheless cautious of Ethereum ETFs turning into as profitable as Bitcoin ETFs. The skepticism mirrors a broader opinion that Ethereum ETFs could not spark the numerous value will increase that they had first anticipated.